India’s pharmaceutical industry is a global powerhouse, contributing 20% of the world’s

generic medicines and ranking 3rd worldwide in terms of production volume. However,

as global demand grows and regulations tighten, Indian pharma firms face rising pressure to

maintain quality, efficiency, and compliance.

One strategic way forward? Deploying robotic solutions—particularly advanced quadruped

and humanoid robots like those from Unitree.

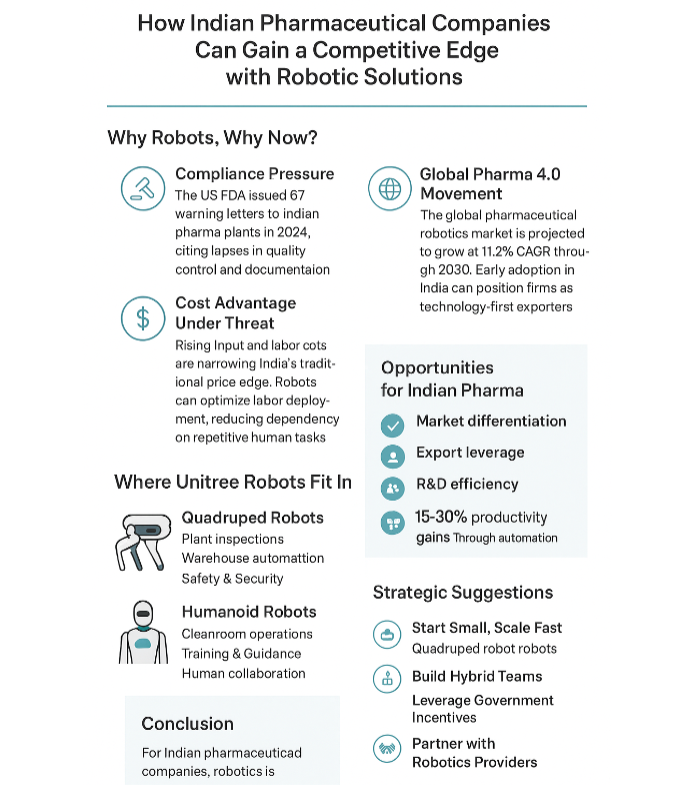

Why Robots, Why Now?

1. Compliance Pressure

The US FDA issued 67 warning letters to Indian pharma plants in 2024,

citing lapses in quality control and documentation.

Robots reduce human error and ensure precise, auditable processes.

2. Cost Advantage Under Threat

Rising input and labor costs are narrowing India’s traditional price edge.

Robots can optimize labor deployment, reducing dependency on repetitive

human tasks.

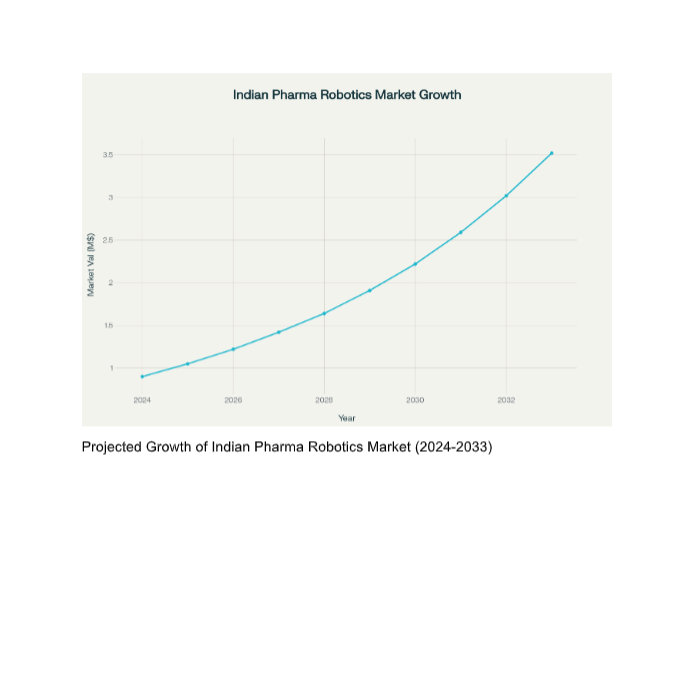

3. Global Pharma 4.0 Movement

The global pharmaceutical robotics market is projected to grow at 11.2%

CAGR through 2030.

Early adoption in India can position firms as technology-first exporters.

Where Unitree Robots Fit In

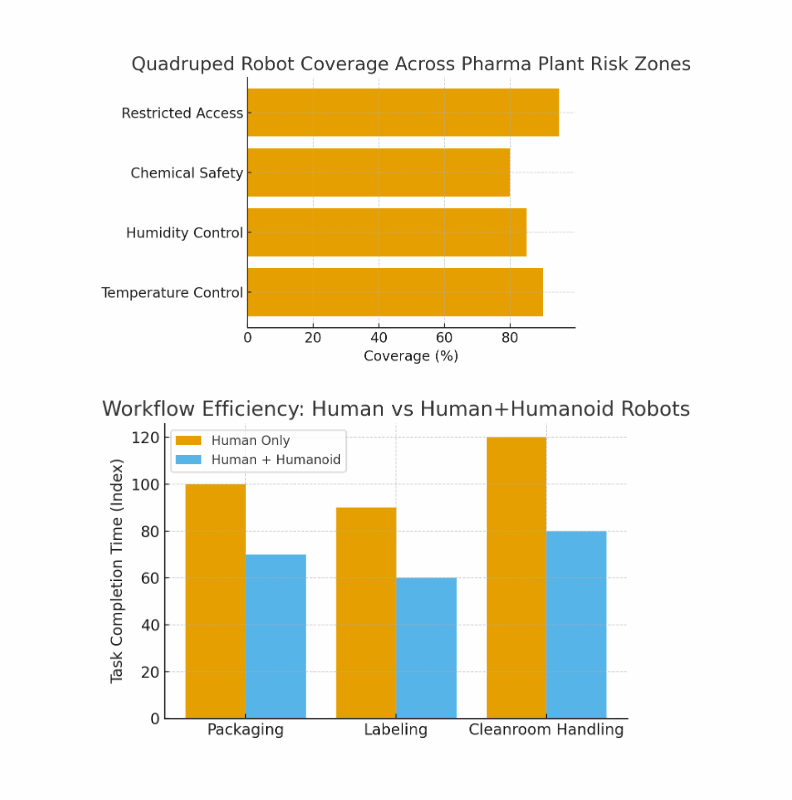

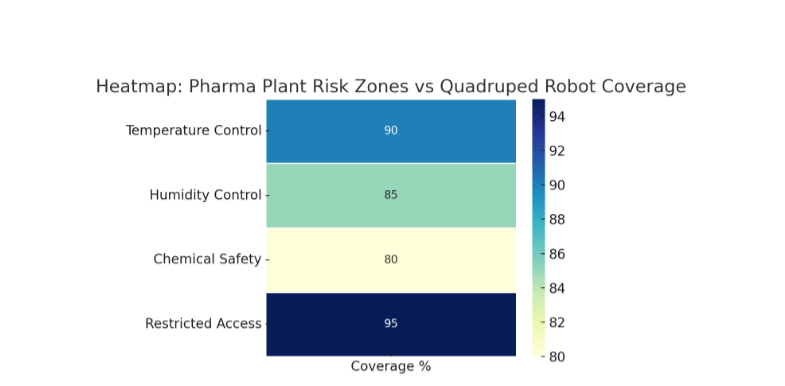

1. Quadruped Robots

Plant Inspections: Navigate factory floors and hazardous areas to detect anomalies in

temperature, humidity, or chemical leaks.

Warehouse Automation: Carry materials between production zones, ensuring

compliance with sterile handling.

Safety & Security: Monitor restricted access zones with thermal and vision sensors.

Heatmap chart of pharma plant risk zones vs. quadruped robot coverage.

2. Humanoid Robots

Cleanroom Operations: Execute delicate tasks like weighing, mixing, or transferring

APIs under sterile conditions.Training & Guidance: Act as interactive digital trainers for new staff in GMP

(Good Manufacturing Practices).

Human Collaboration: Assist in repetitive packaging and labeling, ensuring fewer

rejects.

Workflow diagram comparing human-only vs. human+humanoid task completion times.

Opportunities for Indian Pharma

Market Differentiation:

Being early adopters boosts credibility with regulators and

clients.

Export Leverage: Pharma buyers in the US/EU increasingly demand digitally

monitored, automated facilities.

R&D Efficiency: Robots can handle repetitive assays, freeing scientists for higher-

value innovation.

Stat Spotlight: A McKinsey study suggests pharma companies could achieve 15–30%

productivity gains through automation.

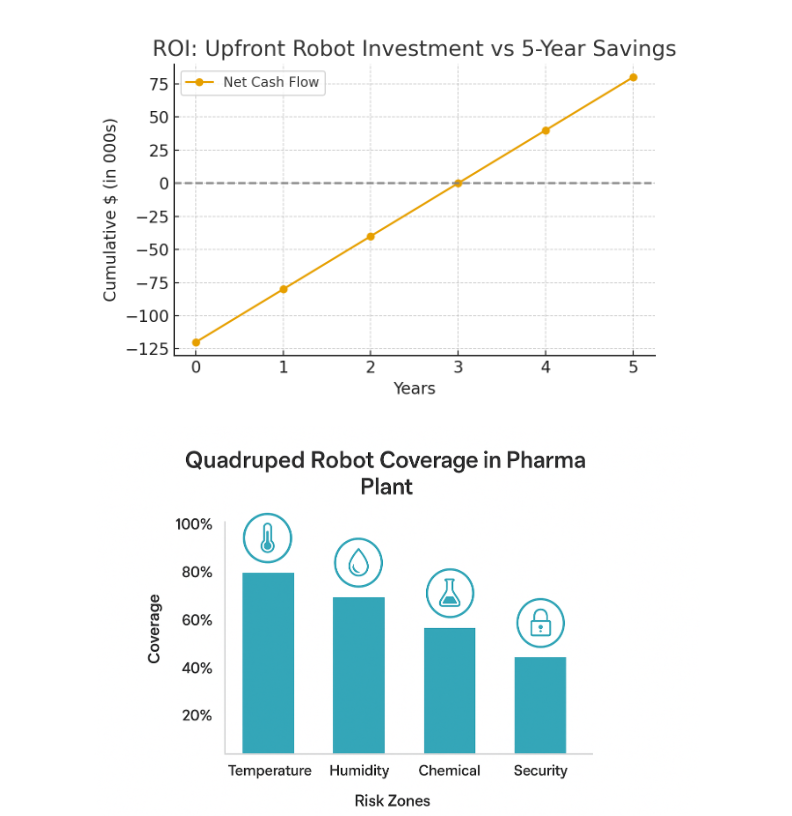

Challenges to Consider

High CAPEX: Unitree’s humanoids cost upwards of $90,000–$150,000 per unit.

Integration Complexity: Robots must interface with MES (Manufacturing Execution

Systems) and ERP software.

Workforce Resistance: Fear of job displacement may slow adoption.

Visual Idea: Bar chart comparing upfront robot investment vs. 5-year cost savings in labor +

compliance penalties avoided.

Strategic Suggestions

1. Start Small, Scale Fast

Pilot quadrupeds in environmental monitoring and safety patrols—quick

ROI use cases.

2. Build Hybrid Teams

Pair humanoid robots with skilled operators in packaging and cleanroom

settings.

3. Leverage Government Incentives

Tap into PLI (Production Linked Incentive) schemes, which reward

automation-led productivity.

4. Partner with Robotics Providers

Collaborate with Unitree distributors for custom pharma-grade adaptations

(sterilizable casings, GMP certifications).

Conclusion

For Indian pharmaceutical companies, robotics isn’t just about replacing labor—it’s about

gaining a competitive edge in global markets. By deploying Unitree’s quadrupeds and

humanoids strategically, firms can:

Improve compliance and audit readiness

Cut costs and reduce operational risks

Signal innovation to global buyers

The companies that move first will likely set the industry standard for the next decade.

1. Quadruped robot coverage across pharma plant risk zones (bar chart).

2. Workflow efficiency comparison: Human-only vs Human+Humanoid robots.

3. ROI projection: Upfront investment vs. 5-year cumulative savings.